Is Cryptocurrency Still a Good Investment Today?

The crypto market is very volatile, thus difficult to predict. However, understanding how prices are set provides guidelines into what are possible and likely price variations.

Visit any discussion forums related to crypto currency and you will find lots of price speculation. Some will debate with historic trends, technological merits or even sheer intuition. The truth remains that the crypto market is very volatile, thus difficult to predict. However, understanding how prices are set provides guidelines into what are possible and likely price variations.

Variable Price

Crypto currencies, like most forms of commodities, are available in a fixed amount at any time. Their value is determined by what people are willing to pay for it. If a currency is popular, fewer people will want to sell it, often at a high price. Unpopular currencies will see their value decrease, as owners will want to sell to limit their loss.

The popularity of a virtual currency is affected by many factors such as:

- How can it be used? Currencies with concrete use cases usually fetch a higher price.

- Who is endorsing the currency? A currency with the backing of a large company or an important personality can see its price increase.

- How does the supply vary? A currency who's total supply goes down over time usually increases in price, as the supply becomes more valuable.

- How reliable is the currency? Public outrage, downtimes and hacks can seriously damage the reputation of a crypto currency, thus making it less attractive.

- How is the stock market? Crypto currencies will often follow variation in the stock market, although with more volatility.

The combination of these factors and many others will influence the confidence of of owners, helping them decide if they want to sell or keep their currency. A good tool to approximate this confidence level is the Coin Screener at Quantify Crypto.

Limits and Market Caps

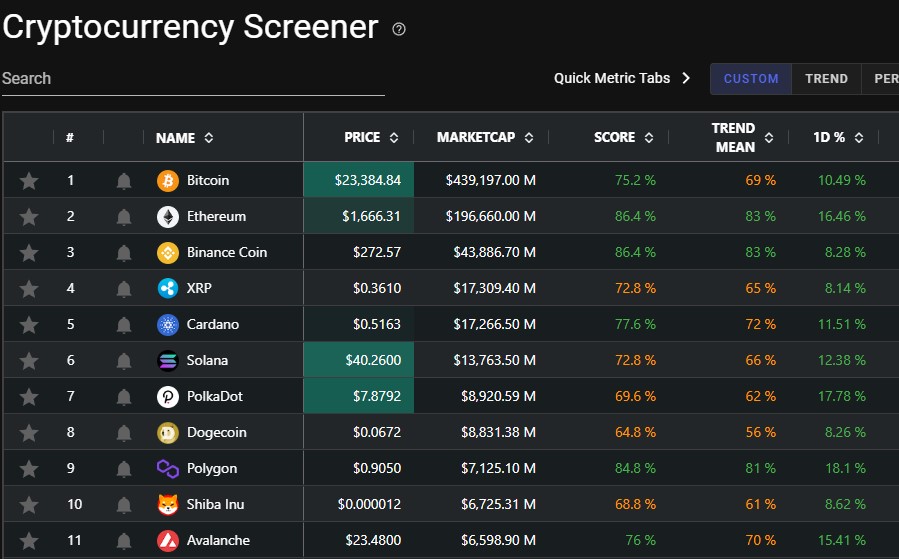

The market cap of a currency is the total value of that currency, often expressed in USD. It is calculated by multiplying the value of a currency by its total circulating supply. The most convenient way to track this is CoinMarketCap, which sorts crypto currencies based on their market cap.

CoinMarketCap is a great resources to track the crypto market.

When trying to determine the potential of a crypto currency, its important to determine its market cap in relation to other currencies. For example, many supporters of Cardano claim the currency could reach a value of 10 USD during the next surge, a 25 time increase over its current value of 0.40 USD. Such an increase would mean that its market cap would reach 340 billion USD, a valuation that would place it among the top 3 currency, with Bitcoin and Ethereum. Another example would be Bitcoin reaching 100K USD, for a total market cap of 19 trillion USD, a value very close of the United State GDP. Although these market caps are not impossible, they are unrealistic, especially in the current market.

Market Manipulation

Given its volatility and lack of regulation, pricing for crypto currency can be easily manipulated. Once common scheme is the Pump and Dump and works as follows:

- A person or a group X purchase a particular low value crypto currency.

- That person or group X then promotes that currency, increasing its popularity.

- The price of that currency increases as newcomers Y rush to purchase mostly because of FOMO.

- The person or group X sell the recently acquired currency at a large profit.

- The large amount of sale crashes the price, leaving newcomers Y with a worthless currency.

Coins with low market cap are easier to manipulate, hence the increase risk in purchasing them. However, they are key signs to detect this type of scam, as described by CoinDesk.

What to do?

Given the high amount of volatility and potential for manipulation, Crypto currencies are one of those investment that should only be done with disposable income. That said, current trends in the crypto market have been cyclical, leaving us with the only guaranty that after prices go up, they will go down (and vice-versa).